For the past couple of months, I have observed myself wondering, how successful businesses make their money, for some, the answer came easy but for others, it required a little more digging. But interestingly enough this path led me to the study of business models.

Without a proper business model, an entrepreneur is bound to fail.

A business model helps founders decide how their business will work, in particular how it will make money.

It is the only documentation that helps you:

- Define your target market

- The market opportunity you intend to capitalize on

- The problems you need to solve,

- The solution your business offers and its value to customers.

- How customers are acquired.

- The costs involved in running the business and staying profitable.

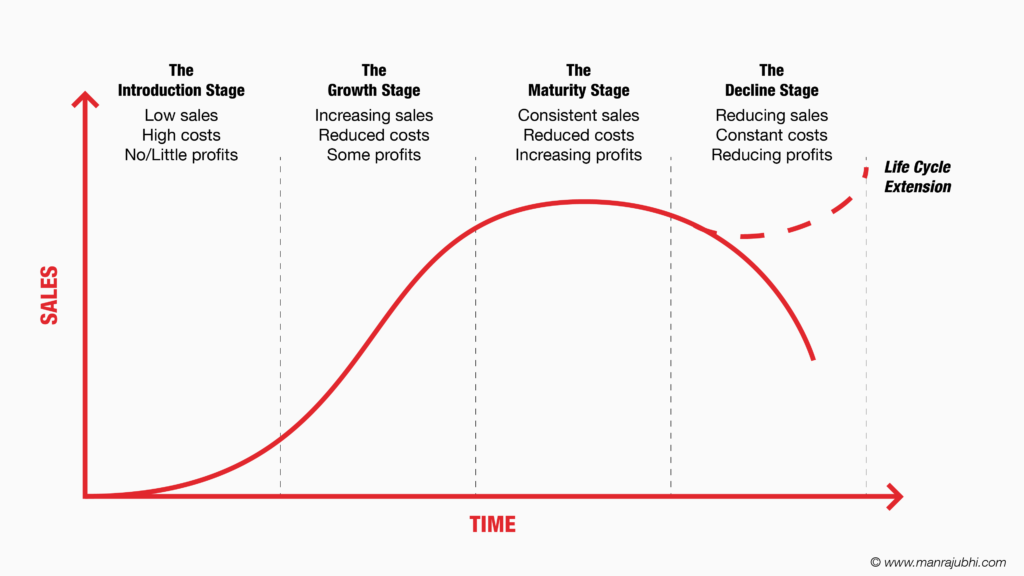

A business model can help you identify what to do differently, which would place you ahead of your competition. For instance, Netflix’s business model proved successful because it provided value in the form of consistent on-demand content instead of the usual TV streaming business model.

Additionally, business models are particularly important for startups, because they help attract investments, recruit talent, and motivate staff.

A business model can simply be defined as a company’s plan for making profit.

The Key ComponentsOf a Business Model

This section is majorly based on the works of Aashish Pahwa of feedough.com. According to Aashish, An ideal business model usually conveys four key aspects of the business which are presented using a specialized tool called business model canvas.

- Who is the customer?

- What value does the business deliver to the customers?

- How does the business operate?

- How does the business make money?

Who Is The Customer?

The customer forms the heart of a business model. It answers who the company plans to sell its offerings to. A business usually groups customers into different segments with certain homogeneous needs, characteristics, or behavior. It then defines one or more customer segments that it serves or wants to serve, followed by an answer to why it plans to serve this segment.

What Value Does The Business Deliver To The Customers?

This is the most important component of a business model that answers several key customer and business value-related questions. It is often usually presented using a value proposition canvas.

- What are the jobs the customer wants to be done?

- What are their pains in doing the job?

- What do they gain by doing the job?

Once these questions are answered, the business answers another set of questions that relates business to the customers:

- How does the business get the job done?

- How does the business relieve the customer’s pain?

- How can the business help the customer get the gains?

How Does The Business Operate?

It’s the operating model of the business that elaborates:

- Key Activities: What offerings do the business sell to the customers.

- Key Partners: Who help the business in delivering value to the customers.

- Key Resources: What/all resources do the business users to develop and deliver its offerings.

- Key Channels: What channels does the business use to deliver its offerings to the customers.

- Customer Relationships: What type of relationships does the business maintain with its customers.

How Does The Business Make Money?

Making money is important for the business to sustain itself. This component of the business model focuses on elaborating on the financials and how the business makes money.

It’s called the revenue model of the business and has two components:

- The cost structure includes all the expenses that the business incurs in creating and delivering value to the customers.

- The revenue streams include all the primary and non-primary revenue streams that the business utilizes.

The 38 Most Common Types of Business Models

- Advertising

- Affiliate

- Agency-Based

- Aggregator

- Auction-Based

- Blockchain

- Brick-and-Mortar

- Bricks-and-Clicks

- Brokerage

- Bundling

- Concierge/Customisation

- Crowdsourcing

- Data Licencing/Data Selling

- Disintermediation

- Distributor

- Dropshipping

- E-commerce

- Fee for service

- Fractionalization

- Franchise

- Freemium

- High Touch

- Leasing

- Leasing Model

- Manufacturer

- Marketplace

- Network Marketing

- Nickel-and-Dime

- On-Demand

- Pay as you go

- Peer 2 Peer Catalyst/Platform

- Razor Blade

- Retailer

- Reverse Auction

- Reverse Razor Blade

- SAAS, IAAS, PAAS

- Subscription

- User Community

1. Auction-Based

Mostly used for unique items that are not frequently traded and that don’t have a well-established market value, like collectibles, antiques, real estate, and even businesses.

This business model involves the listing of an offering by the seller and the buyers making repeated bids to buy that offering while fully aware of other bids by other buyers. The offering is sold to the highest buyer with the auction broker charging a listing fee and/or commission based on the transaction value.

eBay is one such auction platform.

2. Advertising

The fundamentals of the model revolve around creating content that people want to read or watch and then displaying advertising to your readers or viewers.

In an advertising business model, you have to satisfy two customer groups: your readers or viewers, and your advertisers. Your readers may or may not be paying you, but your advertisers certainly are.

With advertising, a business sells its audience’s attention. Advertisers pay for space — whether it’s in the pages of a magazine or on the side of a vehicle — with rates usually determined by the size of the business’s audience.

Examples: CBS, The New York Times, YouTube

3. Affiliate

Affiliate business models are based on marketing and the broad reach of a specific entity or person’s platform. Companies pay an entity to promote a good, and that entity often receives compensation in exchange for their promotion. That compensation may be a fixed payment, a percentage of sales derived from their promotion, or both.

The affiliate business model is related to the advertising business model but has some specific differences. Most frequently found online, the affiliate model uses links embedded in content instead of visual advertisements that are easily identifiable.

Examples: the wirecutter, top ten reviews livewire.

4. Agency-Based

An agency can be considered a partner company that specializes in handling non-core business activities like advertising, digital marketing, PR, ORM, etc. This company partners with several other companies that outsource their non-core tasks to them and is responsible to maintain privacy and efficiency in their work.

Examples: Ogilvy & Mathers, Dentsu Aegis Network, etc.

5. Aggregator

The aggregator business model is a recently developed model where the company has various service providers of a niche and sells its services under its own brand. The money is earned as commissions.

Examples – Uber, Airbnb, Oyo.

6. Blockchain

The Blockchain is an immutable, decentralized, digital ledger. It is a digital database that no one owns but anyone can contribute to. Many businesses are taking this decentralized route to develop their business models. Models based on blockchain are not owned or monitored by a single entity. Rather, they work on peer-to-peer interactions and record everything on a digital decentralized ledger.

7. Bricks-and-Clicks

A company that has both an online and offline presence allows customers to pick up products from the physical stores while they can place the order online. This model gives flexibility to the business since it is present online alternative for customers who live in areas where they do not have brick-and-mortar stores.

Examples – Almost all apparel companies nowadays.

8. Brick and Mortar

Brick-and-mortar is a traditional business model where retailers, wholesalers, and manufacturers deal with the customers face-to-face in an office, a shop, or a store that the business owns or rents.

9. Brokerage

A brokerage business model connects buyers and sellers without directly selling a good themselves. Brokerage companies often receive a percentage of the amount paid when a deal is finalized. Most common in real estate, brokers are also prominent in construction/development or freight.

Example: ReMax, RoadRunner Transportation Systems

10. Bundling

Bundling capitalizes on existing customers by attempting to sell them different products. This can be incentivized by offering pricing discounts for buying multiple products.

This type of business model allows companies to generate a greater volume of sales and perhaps market products or services that are more difficult to sell. However, profit margins often shrink since businesses sell the products for less.

Examples: AT&T, Also many class-based fitness centers and gyms use a type of bundling model, where clients pay fees for a certain number of classes per month. The more classes a client buys, the cheaper each individual class becomes, even though their total spend increases.

11. Concierge/Customization

Some businesses take existing products or services and add a custom element to the transaction that makes every sale unique for the given customer.

For example, think of custom travel agents who book trips and experiences for wealthy clients. You can also find customization happening at a larger scale with products like Nike’s custom sneakers.

Examples: NIKEiD, Journy

12. Crowdsourcing

If you can bring together a large number of people to contribute content to your site, then you’re crowdsourcing. Crowdsourcing business models are most frequently paired with advertising models to generate revenue, but there are many other iterations of the model.

Companies that are trying to solve difficult problems often publish their problems openly for anyone to try and solve. Successful solutions get rewards and the company can then grow its business. The key to a successful crowdsourcing business is providing the right rewards to entice the “crowd” while also enabling you to build a viable business.

Examples: Kickstarter, Patreon

13. Data Licensing/Data Selling

Many companies like Twitter and Onesignal sell or license the data of their users to third parties who then use the same for analysis, advertising, and other purposes.

14. Disintermediation

If you want to make and sell something in stores, you typically work through a series of middlemen to get your product from the factory to the store shelf.

Disintermediation is when you sidestep everyone in the supply chain and sell directly to consumers, allowing you to potentially lower costs to your customers and have a direct relationship with them as well.

Example: Casper, Dell, Apple.

15. Distributor

A company operating as a distributor is responsible for taking manufactured goods to the market. To make a profit, distributors buy the product in bulk and sell it to retailers at a higher price.

Examples – Auto Dealerships.

16. Dropshipping

Dropshipping is a type of e-commerce business model where the business owns no product or inventory but just a store. The actual product is sold by partner sellers who receive the order as soon as the store receives an order from the ultimate customer. These partner sellers then deliver the products directly to the customer.

17. E-commerce

E-commerce focuses on selling products by creating a web store on the internet.

18. Fee for Service

Instead of selling products, fee-for-service business models are centered on labor and providing services. A fee-for-service business model may charge an hourly rate or a fixed cost for a specific agreement. Fee-for-service companies are often specialized, offering insight that may not be common knowledge or may require specific training. To increase their earnings, businesses with this model usually increase their clients or raise their rates.

Example: DLA Piper LLP, Hairstylists, Accountants, and Real estate agents.

19. Fractionalization

Instead of selling an entire product, you can sell just part of that product with a fractionalization business model.

One of the best examples of this business model is timeshares. Where a group of people owns only a portion of a vacation home, enabling them to use it for a certain number of weeks every year.

Examples: Disney Vacation Club, NetJet

20. Franchise

A franchise can be a manufacturer, distributor, or retailer. Instead of creating a new product, the franchisee uses the parent business’s model and brand while paying royalties to it.

The franchiser, or original owner, works with the franchisee to help them with financing, marketing, and other business operations to ensure the business functions as it should. In return, the franchisee pays the franchiser a percentage of the profits.

Examples: Domino’s, Ace Hardware, McDonald’s, Allstate

21. Freemium

Freemium business models attract customers by introducing them to limited-scope products. Then, with the client using their service, the company attempts to convert them to a more premium, advanced product that requires payment. Although a customer may theoretically stay on freemium forever, a company tries to show the benefit of what becoming an upgraded member can hold.

Freemium isn’t the same as a free trial where customers only get access to a product or service for a limited period of time. Instead, freemium models allow for unlimited use of basic features for free and only charge customers who want access to more advanced functionality.

This model is one of the most adopted models for online companies because it is not only a great marketing tool but also a cost-effective way to scale up and attract new users.

Examples: Youtube, MailChimp, Evernote, LinkedIn.

22. High Touch

The high-touch model is one that requires lots of human interaction. The relationship between the salesperson and the customer has a huge impact on the overall revenues of the company. Companies with this business model operate on trust and credibility.

Examples: hair salons, consulting firms.

23. Leasing

Leasing is like renting. At the end of a lease agreement, a customer needs to return the product that they were renting from you.

Leasing is most commonly used for high-priced products where customers may not be able to afford a full purchase but could instead afford to rent the product for a while.

Examples: Cars, DirectCapital

24. Manufacturer

A manufacturer is responsible for sourcing raw materials and producing finished products by leveraging internal labor, machinery, and equipment. A manufacturer may sell goods to distributors, retailers, or directly to customers.

Example: Ford, 3M, General Electric.

25. Marketplace

Marketplaces allow sellers to list items for sale and provide customers with easy tools for connecting to sellers. In exchange for hosting a platform for business to be conducted, the marketplace receives compensation. Although transactions could occur without a marketplace, this business model attempts to make transacting easier, safer, and faster.

Online marketplaces aggregate different sellers into one platform who then compete with each other to provide the same product/service at competitive prices. The marketplace builds its brand over different factors like trust, free and/or on-time home delivery, quality sellers, etc.

The marketplace business model can generate revenue from a variety of sources including fees to the buyer or the seller for a successful transaction, additional services for helping advertise the seller’s products, and insurance so buyers have peace of mind. The marketplace model has been used for both products and services.

Examples: eBay, Airbnb, Amazon, Alibaba

26. Network Marketing

Network marketing or multi-level marketing involves a pyramid-structured network of people who sell a company’s products. The model runs on a commission basis where the participants are remunerated when –

They make a sale of the company’s product.

Their recruits make a sale of the product.

The network marketing business model works on direct marketing and direct selling philosophy where there are no retail shops but the offerings are marketed to the target market directly by the participants. The market is tapped by making more and more people part of the pyramid structure where they make money by selling more goods and getting more people on board.

27. Nickel-and-Dime

In this model, the basic product provided to the customers is very cost-sensitive and hence priced as low as possible. For every other service that comes with it, a certain amount is charged.

Examples – All low-cost air carriers.

28. On-Demand

An on-demand model is a model where a customer’s demand is fulfilled by delivering goods and services on demand (usually immediately). This business model is driven by the use of the internet and mobile phones. It works like this –The customer order for products on services through a web app.

The request is received by the company’s employee or a demand-fulfilling partner. The employee or a partner fulfills the demand by delivering the ordered product or service either immediately or in the time promised.

Examples: Uber, Instacart, and Postmates

29. Pay as you Go

Instead of charging a fixed fee, some companies may implement a pay-as-you-go business model where the amount charged depends on how much of the product or service was used. The company may charge a fixed fee for offering the service in addition to an amount that changes each month based on what was consumed.

Example: Utility companies, Water Companies

30. Peer 2 Peer Catalyst/Platform

A P2P economy is a decentralized internet-based economy where two parties interact directly with each other to buy or sell goods or to conduct a transaction without the intervention of any third party. A P2P catalyst is a platform where these users meet.

Examples: Craigslist, OLX, Airbnb, etc.

31. Product-as-a-service model

Product-as-a-service businesses charge customers to use physical products. They may charge a subscription fee, a per-use or per-mile fee, or a combination of both.

Example: Bike rental companies offer products as a service. Customers might pay an annual membership fee plus a per-mile fee each time they ride, or they might have the option to rent a bike for the day.

32. Razor Blade

This business model aims to sell a durable product below cost to then generate high-margin sales of a disposable component of that product.

This is why razor blade companies –like Gillette- practically give away the razor handle, assuming that you’ll continue to buy a large volume of blades over the long term. The goal is to tie a customer into a system, ensuring that there are many additional, ongoing purchases over time.

Examples: Gillette, Inkjet printers, Xbox.

33. Retailer

This is one of the more common business models. A retailer is the last link in the supply chain. These businesses purchase goods from manufacturers or distributors and then sell them to customers for a price that will cover expenses and turn a profit. Retailers may specialize in a particular niche or carry a range of products.

Examples are Costco Wholesale, Amazon, and Tesco.

34. Reverse auction

A reverse auction business model turns auctions upside down and has sellers present their lowest prices to buyers. Buyers then have the option to choose the lowest price presented to them.

The reverse-auction-based business model is often used when there are several sellers selling a similar offering to a single buyer. These sellers lower their price with every bid and generally the bidder with the lowest bid wins the auction. However, there are cases when the bidder with a price higher than the lowest bid wins the auction as the buyer likes his offer (offering with add-ons)

Examples: Priceline.com, LendingTree

35. Reverse Razor Blade

Instead of relying on high-margin companion products, a reverse razor blade business model tries to sell a high-margin product up front. Then, to use the product, low or free companion products are provided.

Similar to the razor blade model, customers are often choosing to join an ecosystem of products. But, unlike the razor blade model, the initial purchase is the big sale where a company makes most of its money. The add-ons are just there to keep customers using the initially expensive product.

Example: Apple (iPhones + applications), Peloton

36. SAAS, IAAS, PAAS

Many companies have started offering their software, platform, and infrastructure as a service. The ‘as a service business model works on the principle of pay as you go where the customer pays for his usage of such software, platform, and infrastructure; he pays for what and how many features he has used and not for what he hasn’t.

37. Subscription

Subscription-based business models strive to attract clients in the hopes of luring them into long-time, loyal patrons. This is done by offering a product that requires ongoing payment, usually in return for a fixed duration of benefit.

While magazine and newspaper subscriptions have been around for a long time, the model has now spread to software and online services and is even showing up in service industries.

If customer acquisition costs are high, this business model might be the most suitable option. The subscription business model lets you keep customers over a long-term contract and get recurring revenues from them through repeat purchases.

Examples: Netflix, Salesforce, Comcast.

A subscription business model can be applied to both traditional brick-and-mortar stores and e-commerce businesses alike. Essentially, the customer makes a recurring payment for ongoing access to a service or product. A company may directly ship its product in the mail, or you may pay a fee to use its services.

Example: Many local farms offer farm shares or community-supported agriculture subscriptions, where clients get access to fresh produce on an ongoing basis while crops are in season.

38. User Community

Driven by the network effect, this business model involves granting access to a community or a network in return for a membership fee.

Glassdoor is a good example of such a user community.

Final Thoughts

As you have gone through this post you might have realized that there are companies that use more than one business model. For instance, Microsoft. Over the past several decades, the company has expanded its product line across digital services, software, gaming, and more. This is important to know because, for a business model to work in practice, it has to make sense for the business that adopts it. Therefore you should always consider how your business model fits with your business ideas and consistently review this over time, during the course of your business. And should you feel the need to fuse a couple of business models to achieve your business objectives, by all means, go for it!